Created with Datawrapper

What trade war? Music stocks, as well as the S&P 500 and Nasdaq, closed at record highs on Friday (June 27) despite President Trump’s claim that the U.S. broke off trade negotiations with Canada.

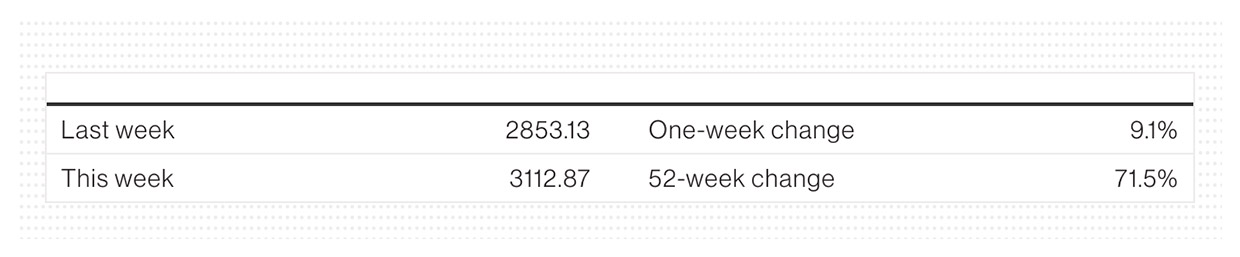

Spotify set a new record of $785.00 on Friday, briefly valuing the company at nearly $161 billion, and closed at $772.60, up 9.2% for the week. The stock gained 5.4% on Thursday (June 26) after Guggenheim raised its Spotify price target to $840 from $725. On Friday, UBS raised its SPOT price target to $895 from $680 and maintained its “buy” rating. Spotify shares have gained 65.6% year to date and have increased 145.7% over the last 52 weeks.

While bullish on Spotify’s long-term potential, Guggenheim lowered its estimates for second quarter revenue and operating income and third quarter gross margin (to 31.2% from 31.5%), and left its forecast for 2025 gross margin unchanged. In calculating a discounted cash flow valuation, analysts lowered the weighted average cost of capital to 7.9% from 8.0% to reflect a lower risk-free rate. (A lower discount rate results in a higher valuation.) Guggenheim analysts also accounted for a stronger euro, which will have a negative impact on Spotify’s reported revenue, as well as social charges related to share price appreciation.

“Beyond these accounting changes,” Guggenheim analysts wrote in their note to Spotify investors, “our conviction in the mid- and long-term growth opportunity at the global streaming audio leader remains intact with core pricing power, potential tier expansion, expanded delivery of audio formats (led by audiobooks and podcasts) and the early-stage commerce opportunity presented by app-store changes underpinning our confidence.”

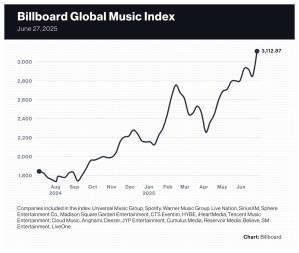

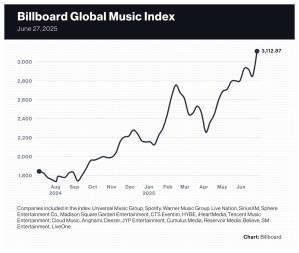

Spotify’s stellar week helped the 20-company Billboard Global Music Index (BGMI) rise 9.1% to a record 3,112.87, exceeding the 3,000 mark for the first time. The index was skewed by a high number of valuable winners and few valuable losers. The BGMI’s six most valuable companies finished in positive territory. HYBE, the seventh most valuable music company on the index, was the most valuable company among the week’s declines.

Rarely does the index have such a large gain in a single week. The BGMI’s 9.1% improvement was the second-largest one-week gain in the index’s nearly three-year history, behind only a 12.7% gain in the week ended Nov. 11, 2022. Only five music stocks lost value during the week, compared to 13 gainers and 2 that were unchanged.

Markets around the world finished the week in positive territory. In the U.S., the Nasdaq jumped 4.2% and the S&P 500 rose 3.4%. In the U.K., the FTSE 100 was up 0.3%. South Korea’s KOSPI composite index improved 1.1% to 3,055.94. China’s SSE Composite Index gained 1.9% to 3,424.23.

Sphere Entertainment Co. was the week’s greatest gainer, rising 10.2% to $42.47 after Craig-Hallum initiated coverage with a $75 price target and a “buy” recommendation. The gain erased Sphere Entertainment’s year-to-date deficit and took its 52-week gain to 21.2%. The Sphere venue in Las Vegas is currently hosting a 15-show Kenny Chesney residency and will begin a 21-date run by Backstreet Boys on July 11.

Universal Music Group (UMG), the index’s second most-valuable component, rose 2.2% to 27.32 euros ($32.02). On Wednesday (June 25), UBS downgraded UMG shares to “neutral” from “buy” but maintained its price target at 30.00 euros ($35.16). UMG boasts a $58.1 billion market capitalization and has gained 14.3% year to date.

Other record labels and publishers fared well this week. Warner Music Group rose 2.8% to $27.20, which reduced its year-to-date deficit to -12.3%. Reservoir Media improved 1.7% to $7.62, taking its 2025 decline to -9.9%.

Live entertainment companies collectively fared the best of all music stocks, posting an average gain of 4.0%. In addition to Sphere Entertainment’s double-digit gain, MSG Entertainment climbed 5.4% to $40.50, CTS Eventim improved 1.8% to 104.40 euros ($122.37) and Live Nation increased 0.8% to $149.99.

K-pop companies were an exception to the week full of winners, as each of the four South Korean companies lost value. JYP Entertainment fell 3.0%, YG Entertainment dropped 1.6% and both SM Entertainment and HYBE fell 0.5%.

The week’s biggest loser was radio giant iHeartMedia, which fell 6.0% to $1.72. With the first half of 2025 nearly over, iHeartMedia shares have dropped 19.2% year to date.

Created with Datawrapper

Created with Datawrapper

Created with Datawrapper

Stay up to date on exciting projects and upcoming events from the Black Promoters Collective.

©2025 Black Promoters Collective (BPC) All Rights Reserved.