Stay

UpdateD

Join the BPC

Email List

Stay up to date on exciting projects and upcoming events from the Black Promoters Collective.

President Donald Trump’s major budget bill, also known as the “Big Beautiful Bill” narrowly passed in the Senate, bringing it one step closer to becoming law. While the current version of the bill differs somewhat from the version initially passed by the House of Representatives, the bill still includes massive tax cuts geared toward the wealthy and major cuts to social spending such as Medicaid and health insurance, and it is projected to result in trillions of dollars added to the national debt.

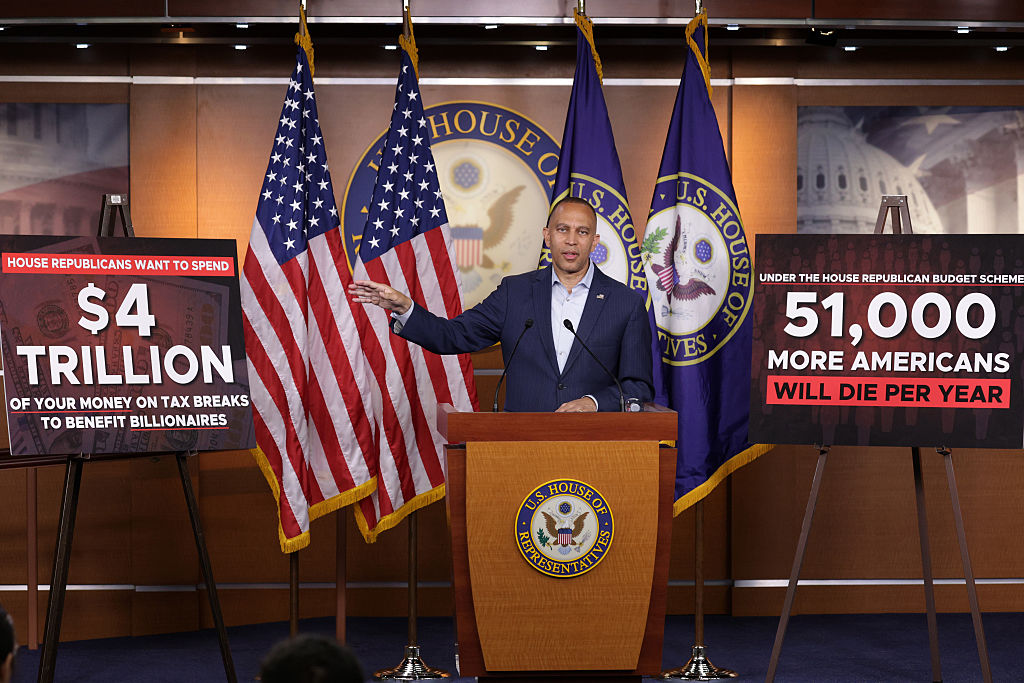

Perhaps the biggest concern about the bill from its opponents is its impact on health care in the United States. The current version of the bill cuts about $1 trillion in federal spending for Medicaid, which provides health care for low-income individuals, and the Affordable Care Act, the signature policy of the Obama administration that expanded health insurance for millions of Americans. The bill also creates stricter standards for accessing these programs, such as a more stringent work requirement for Medicaid recipients that experts say will raise costs and exclude otherwise eligible people from receiving benefits. The bill also increases the paperwork associated with gaining and maintaining eligibility for these programs. Altogether, it is estimated that almost 12 million people could lose their health care by 2034 under the plan, according to NPR, with costs going up for many more people as well.

Beyond its direct impact on health care, the Trump bill also impacts trillions of dollars in taxes and spending. It would make permanent the tax cuts Trump signed into law in 2017, which primarily benefit wealthy Americans and were set to expire at the end of 2025. Benefits to non-wealthy Americans would include a slight raise in the child tax credit (which had been lowered under the House version of the bill), and a tax deduction for income from tips and overtime pay. The bill also increases spending for the military as well as for border security and immigration control, including billions for a border wall between the United States and Mexico, expanded immigration detention facilities, and the hiring of 10,000 additional Immigration and Customs Enforcement agents. The bill also cuts back tax incentives for clean energy.

The nonpartisan Congressional Budget Office estimates that the Senate version of the bill that passed on Tuesday would raise the national deficit by $3.2 trillion over the next decade, which is even more than the $2.8 trillion that the earlier House version would add to the national debt. This increase in deficit spending has drawn opposition from conservative Republicans affiliated with the House Freedom Caucus as well as former Trump allies such as Elon Musk, who had a dramatic public falling-out with the president over the bill and who continues to speak out against it on his X social media platform.

Debate over the Trump bill continued Wednesday, as Trump has pushed Republicans in Congress to pass the legislation by July 4. With versions of the legislation narrowly passing each chamber of Congress and with some Republicans still wary of approving the final version, it is not yet certain that the bill will go through. But if it does manage to clear Congress, millions of people will feel the impact of this bill for years to come.

Stay up to date on exciting projects and upcoming events from the Black Promoters Collective.

©2025 Black Promoters Collective (BPC) All Rights Reserved.